Startup funding is really a crucial component for business owners in Australia aiming to switch their innovative Tips into practical businesses. Using a different funding resources accessible, from federal federal government grants to non-community investment decision, Australian startups acquire usage of important resources which will help them triumph over economical boundaries and fuel advancement.

Varieties of Startup Funding in Australia

Federal government Grants and Courses: The Australian governing administration provides several grants and incentives specifically for startups. One particular from the hottest will be the Investigate and Progress (R&D) Tax Incentive, which provides tax offsets to organizations committing to suitable R&D actions. An additional noteworthy method is the Business owners' Programme, which gives funding and professional assistance to help startups increase their competitiveness and efficiency.

The New Business Incentive Plan (NEIS) is an additional beneficial initiative that gives coaching, mentoring, and profits help to qualified people starting off a completely new enterprise. This is specially beneficial for business owners who need to have foundational assistance to construct their ventures your self.

Venture Capital (VC): Enterprise capital is really a important way to get funding for Australian startups, specifically those in know-how and innovation sectors. VC corporations supply budgets in return for fairness, typically concentrating on significant-advancement prospective businesses. Notable VC corporations in Australia contain Blackbird Ventures, Sq. Peg Capital, and Airtree Ventures. These companies commonly invest in early-phase startups, providing not simply capital as well as precious business enterprise skills, connections, and mentorship.

Angel Traders: Angel investors are people who give early-phase funding to startups, ordinarily to accumulate fairness. These buyers frequently search for out significant-possibility, significant-reward alternatives which help it to be referred to as a useful offer of funds for startups that could not nevertheless qualify for funds raising or loans from banking institutions. Angel investors in Australia, like Sydney Angels and Melbourne Angels, provide mentorship and steerage.

Crowdfunding: Crowdfunding has emerged as becoming a common implies for startups to boost funds in Australia. Platforms like Pozible, Kickstarter, and Indiegogo enable business owners to pitch their tips to persons and collect compact contributions from the substantial range of backers. This technique is specifically captivating for creative, social, or Group-pushed projects.

Accelerators and Incubators: Numerous Australian startups make full use of accelerator and incubator systems. These systems, by way of example Startmate and BlueChilli, provide funding, mentorship, and resources in Trade for fairness. They're created to rapid-keep track of the roll-out of startups, offering intense guidance above the quick while.

Problems and check here Issues

Though there are plenty of funding options readily available, Level of competition is intense. Securing startup funding generally requires a strong strategic company system, crystal clear economical projections, as well as a persuasive pitch that demonstrates the viability and scalability from the notion. Furthermore, business people need to be conscious with the phrases connected to Each and every funding resource, such as fairness dilution with VC or angel investments.

Conclusion

Startup funding in Australia is assorted, providing combining authorities assistance, private expenditure, and alternative ways like crowdfunding. With the right method and preparing, business owners can employ these sources to gas their enterprise growth, accelerate innovation, and establish a potent market place existence. No matter whether it’s via grants, expansion capital, or undertaking cash angel investors, Australian startups have entry to a variety of alternatives to show their Tips into prosperous organizations.

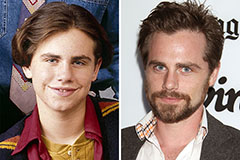

Rider Strong Then & Now!

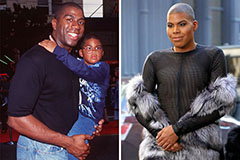

Rider Strong Then & Now! Earvin Johnson III Then & Now!

Earvin Johnson III Then & Now! Nancy Kerrigan Then & Now!

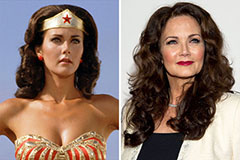

Nancy Kerrigan Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Nadia Bjorlin Then & Now!

Nadia Bjorlin Then & Now!